As a cardiologist, I see firsthand how proactive planning can improve both health and finances. One tool I often recommend patients consider is a Health Savings Account (HSA). Here’s why HSAs are a smart choice for managing healthcare expenses:

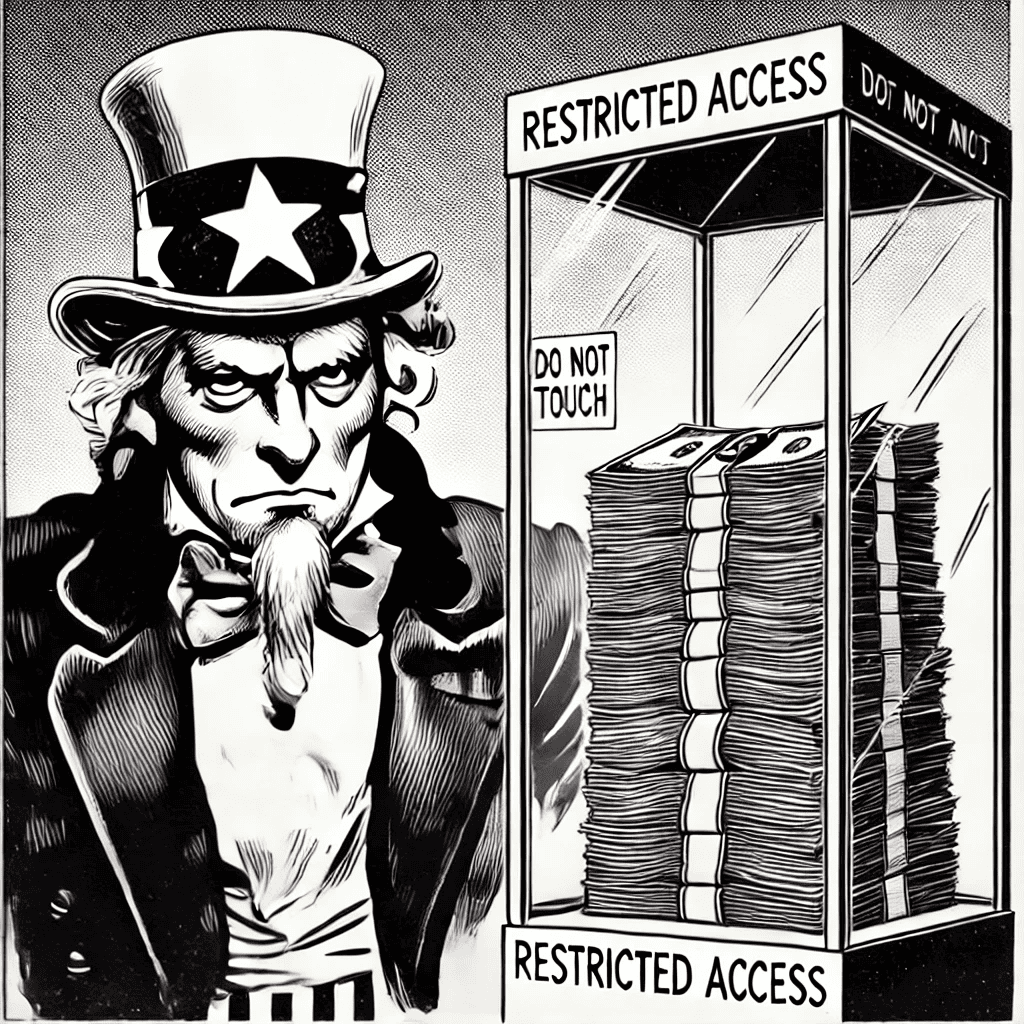

• Tax Advantages: Contributions are tax-deductible, grow tax-free, and withdrawals for qualified medical expenses are also tax-free. It’s a triple tax benefit that makes your money work harder for you.

• Flexibility: Unlike a Flexible Spending Account (FSA), unused funds roll over every year. Your HSA grows with you, providing long-term savings potential.

• Portability: HSAs aren’t tied to your employer. Whether you change jobs, retire, or move, your account stays with you.

• Long-Term Savings: Funds in an HSA can be invested, offering an opportunity to build a financial cushion for future medical expenses—especially helpful in retirement when healthcare costs often increase.

• Encourages Preventative Care: With an HSA, you’re more likely to plan for and address medical needs early, which can help prevent costly complications down the road.

HSAs empower you to take control of your healthcare finances while encouraging thoughtful, proactive decisions about your care. If you’re enrolled in a high-deductible health plan, an HSA could be a game-changer for your financial and medical wellbeing.

For more tips on managing your health and finances, explore my website or book an appointment. Together, we can keep your heart—and your budget—on the right track.

Leave a Reply